A Quick Guide to the Role of a Nonprofit Treasurer

Your nonprofit’s board of directors exists to provide oversight for your organization. Having a group of dedicated individuals strategically guiding your nonprofit is essential for effective operations, whether you’re working toward a major fundraising campaign goal or trying to deliver the best possible services in your community day-to-day.

Financial management is one of the most important areas of nonprofit operations that the board oversees, and the individual who takes the lead on this is your organization’s treasurer. According to Jitasa, a nonprofit treasurer is “a member of the board of directors [who] serves as the financial liaison between the nonprofit’s board and staff.”

In this guide, you’ll learn the basics of who a nonprofit treasurer is and what they do, including:

- Qualities of a Nonprofit Treasurer

- Responsibilities of a Nonprofit Treasurer

- The Treasurer’s Place in Your Nonprofit’s Financial Management Structure

Choosing the right person to fill the role of treasurer helps increase accountability and transparency around your nonprofit’s finances. In turn, donors and stakeholders will be more likely to trust that your organization will actually use their contributions to make a difference in the community, leading to stronger, long-term support for your mission. Let’s get started!

Qualities of a Nonprofit Treasurer

Your nonprofit could find its treasurer by choosing an existing board member to fill the role or by recruiting externally. Either way, the treasurer needs to be officially nominated by one of your organization’s leaders, another board member, or a search committee. Then, the whole board will confirm the nomination by voting.

To ensure your nonprofit chooses a treasurer who will do the job well, look for the following qualities in your nominee:

- Leadership abilities. While treasurers at small organizations may be the only person in charge of financial oversight, they might chair a finance or audit committee as your nonprofit grows. So, they should be good at leading others from the start to prepare them for that responsibility.

- Communication skills. Treasures need to communicate effectively in both oral and written formats in order to fulfill their reporting duties and collaborate with your organization’s other financial professionals (more on both of these later!).

- Organization and time management. Attention to detail is critical for governance, especially when it comes to ensuring accuracy in your nonprofit’s finances. Plus, your treasurer will likely need to keep track of multiple projects at any given time.

- Trustworthiness. In order for your treasurer to evaluate your organization’s financial situation and create accurate reports, they’ll need access to sensitive information in your accounting software. Train them in data security best practices and make sure you trust them to handle this information properly before granting them access to your database.

- Financial expertise. Of course, the most important characteristic of a treasurer is that they understand nonprofit financial management best practices and can make informed decisions to help your organization achieve its goals.

Additionally, the best treasurer for your nonprofit will care about your mission, since their passion will make them more inclined to act in your nonprofit’s best interest.

Responsibilities of a Nonprofit Treasurer

Nonprofit treasurer duties fall into two main categories: financial governance and reporting. Let’s look at each of these in more detail.

Financial Governance

Although the treasurer may be involved in the actual creation of some strategies and documents (especially at smaller nonprofits), most of what they do is provide direction as other financial professionals do the hands-on work of financial management. For instance, the treasurer might:

- Lay out the financial goals for the organization’s overall strategic plan

- Approve operating, capital, and program budgets and suggest revisions to them as needed

- Provide advice on the development and application of fiscal policies and procedures

- Oversee the implementation of risk management plans

- Check that all required documentation has been compiled prior to a financial audit

Essentially, your treasurer should ensure that your organization maintains compliance in its financial management practices and is headed in the right direction for future growth and sustainability.

Reporting

In addition to reviewing your nonprofit’s yearly financial reports (such as its tax return and the finance section of its annual report), the treasurer will compile reports of their own on either a monthly or annual basis. While they may vary in their scope, the core elements of a nonprofit treasurer report include:

-

- Basic details like the organization’s name, the time period the report covers, and the treasurer’s signature to prove the report’s legitimacy

- Your nonprofit’s initial cash balance from the reporting period

- All revenue earned during the reporting period from individual donations, corporate philanthropy, grants received, investment returns, and other income sources

- All expenses incurred during the reporting period, whether they’re related to your organization’s programming, administrative needs, or the upfront costs of running fundraising campaigns

-

- Your nonprofit’s final cash balance from the reporting period

- Any additional notes or highlights the treasurer deems useful to mention in the report, such as budget vs. actual comparisons or revenue and expense projections for the upcoming reporting period

The treasurer will typically present their reports at monthly board meetings, and they may also reference them in conversations with external stakeholders. Additionally, Double the Donation recommends providing an overview of your nonprofit’s current financial situation to new board members during their orientation, and recent treasurer reports can come in handy there as well.

The Treasurer’s Place in Your Nonprofit’s Financial Management Structure

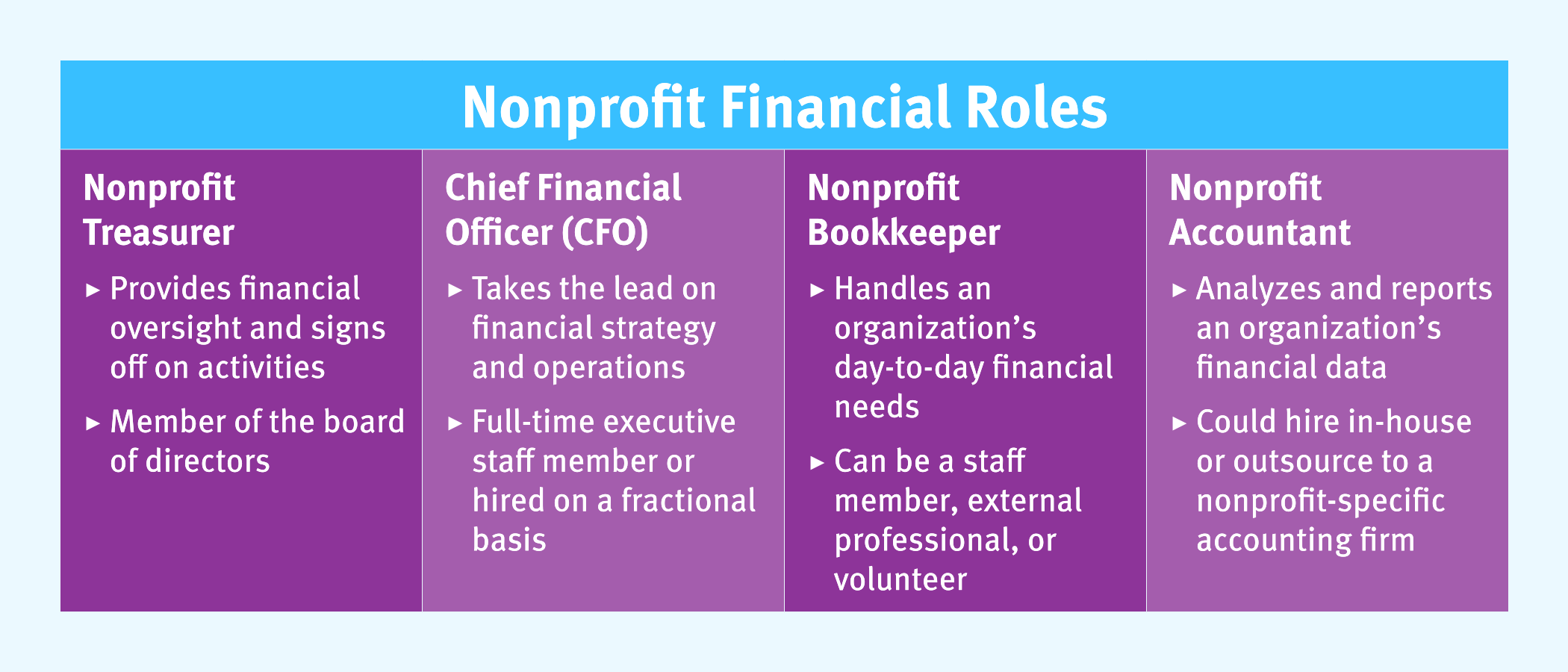

As mentioned previously, your treasurer isn’t the only individual involved in managing your nonprofit’s finances. There are three other financial professionals with different responsibilities that your organization should have on its team:

- Chief financial officers (CFOs) are in charge of financial strategy and operations, such as budget creation, cash flow forecasting, and grant management. Depending on your nonprofit’s size and needs, this individual might be a member of your executive leadership team or hired on a fractional basis.

- Bookkeepers handle your nonprofit’s financial needs and resources day-to-day, from recording data in your accounting system to writing checks and making deposits. Since this role doesn’t require specialized education or certifications, your bookkeeper could be a staff member, a contracted professional, or even a trusted volunteer.

- Accountants analyze and report your organization’s financial data. Their main duties include reconciling bank statements, compiling financial statements, and filing tax forms. Accountants need to have a CPA certification to do their job properly, so you’ll likely either have to bring on a full-time team member or outsource this role to a nonprofit accounting firm.

Although each financial professional has their own focus area, they often work together on important projects. Take creating your nonprofit’s annual operating budget, for example. Your CFO will likely be the one to actually write out the budget, but they’ll base their projections on data recorded by your bookkeeper and analyzed by your accountant. Your accountant may also provide feedback on drafts of the budget before it goes to your treasurer for final approval.

The role of your nonprofit treasurer is vital to proper financial management at your organization. When a well-qualified individual who takes their duties seriously oversees how your nonprofit handles its resources, you can more effectively protect against risks and secure your organization’s reputation as a responsible force for good in the community.